“America’s Fiscal Health Under Fire: Elon Musk Warns of Impending Bankruptcy. Interest payments now consume 25% of federal tax revenue. What’s next for the US economy?”

Key Facts:

Elon Musk posted on X Tuesday, warning that the U.S. is nearing “de facto bankruptcy.”

Federal debt has surpassed $37 trillion, with $1.2 trillion in annual interest payments.

Interest payments now consume 25% of all federal tax revenue, per Musk and Wall Street Mav.

Economist Peter Schiff and JPMorgan CEO Jamie Dimon echoed warnings of economic breakdown.

Musk criticized both parties for overspending, calling recent GOP legislation “a disgusting abomination.”

The Rest of The Story:

Elon Musk is raising alarms about America’s fiscal health, warning that the federal government is headed toward a financial disaster.

Citing data from a post on X by Wall Street Mav, Musk noted that with $5 trillion in federal revenue and $7 trillion in spending, the growing $1.2 trillion in interest payments now accounts for 25% of all tax income.

Peter Schiff backed up Musk’s post, stating, “We already are bankrupt. It’s just a matter of time before it’s obvious to our creditors.”

He warned that once this reality hits global bondholders, “interest rates will skyrocket,” and the Federal Reserve may respond by triggering runaway inflation to keep the system afloat.

JPMorgan CEO Jamie Dimon has also sounded alarms, warning of a potential “crack in the bond market” if Washington fails to rein in spending.

Musk, once head of the Trump administration’s Department of Government Efficiency (DOGE), also blasted Republicans for reckless spending, calling their latest budget bill “massive, outrageous, pork-filled.”

Commentary:

Once again, Elon Musk is pointing out the obvious to a deaf government.

America is spending like a spoiled trust fund kid with no plan to pay the bill.

Families and businesses with this kind of balance sheet—more than $37 trillion in debt, spending far more than they take in, and making minimum payments on the credit card—would be bankrupt in no time.

What’s keeping this circus going?

The Federal Reserve prints more money, props up bond markets, and buys time.

But time is running out.

Once interest payments chew up the entire federal revenue stream, there’s nothing left for defense, healthcare, or infrastructure.

That’s when the collapse becomes obvious to even the casual observer.

Peter Schiff is right: we’re already bankrupt.

The only reason the world hasn’t called our bluff is because the dollar still holds reserve status.

But that privilege is based on confidence—and confidence evaporates fast when creditors see you can’t make good on your promises without inflating away your debt.

Jamie Dimon isn’t blowing smoke either.

If the bond market cracks and yields spike, debt servicing costs could explode past all tax revenue.

That would mean borrowing to pay the interest on our borrowing.

At that point, the music stops—and the global financial system takes a hit that could dwarf 2008.

Congress isn’t helping.

Both parties seem more interested in short-term political wins than fiscal survival.

Musk rightly called the GOP’s latest spending bill an abomination.

It’s not just Democrats pushing big budgets, it’s everyone.

Without serious, structural reform—spending cuts, entitlement reform, and a return to fiscal responsibility—we are on a glide path to disaster.

Kicking the can has been the strategy for decades.

Eventually, we run out of road.

The Bottom Line:

Elon Musk’s warning isn’t just a social media post—it’s a dire forecast grounded in hard math.

With debt at historic highs and interest consuming 25% of tax revenue, the U.S. is heading toward an economic wall.

Unless lawmakers change course fast, America’s fiscal crisis won’t just be a theory.

It’ll be a reality the bond markets, and the world, can no longer ignore.

News

HOPE AND SUPPORT FOR TEXAS! The Dallas Cowboys, Houston Texans and NFL Foundation have joined forces to donate $1.5 million towards rescue, relief, and recovery efforts in Texas. Share your thoughts and messages of support.

Texas Longhorns Donate $1 Million to Support Flash Flood The University of Texas at Austin has made a significant contribution…

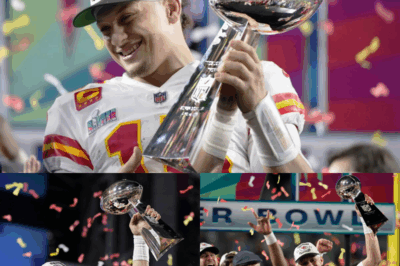

CHIEFS’ FRANCHISE PLAYER! Patrick Mahomes remains the face of the Kansas City Chiefs after a thrilling Super Bowl victory and a lucrative new contract. Share your thoughts on his future with the team.

Patrick Mahomes Remains the Center of Attention After Super Bowl Triumph and New Contract with Kansas City Chiefs Introduction Patrick…

BRADY’S NEW PLAY! Tom Brady’s prioritizing his Fox Sports commentary role amid swirling comeback rumors. Get the latest on his post-retirement plans and share your thoughts.

Tom Brady Remains Firm in Retirement, Focuses on Fox Sports Commentary Amid Comeback Rumors Introduction Tom Brady, widely regarded as…

CONTROVERSY ROCKS ANTHONY EDWARDS’ WORLD! The NBA star faces allegations from his ex-girlfriend about his relationship with their daughter. Dive into the details and join the conversation.

Anthony Edwards’ Ex-Girlfriend Claims He Has Never Met Their Daughter: A Closer Look at the NBA Star’s Personal Controversy Introduction…

THE FACE OF THE LEAGUE! A’ja Wilson is more than just a dominant player – she’s a cultural force, a role model and a relentless advocate for women’s sports. Discover her inspiring story.

A’ja Wilson: The Reigning Empress of the WNBA and Her Lasting Legacy Introduction In the heart of the WNBA’s most…

A BASKETBALL REVOLUTION! Stephen Curry’s innovative playing style has changed the game forever. Get a glimpse into his remarkable career and lasting influence on the sport.

Stephen Curry: The Architect of Basketball’s Modern Revolution Introduction In the annals of basketball history, few names shine as brightly…

End of content

No more pages to load